BitDAO Staking

FOR

BitDAO

ROLE

Product Design

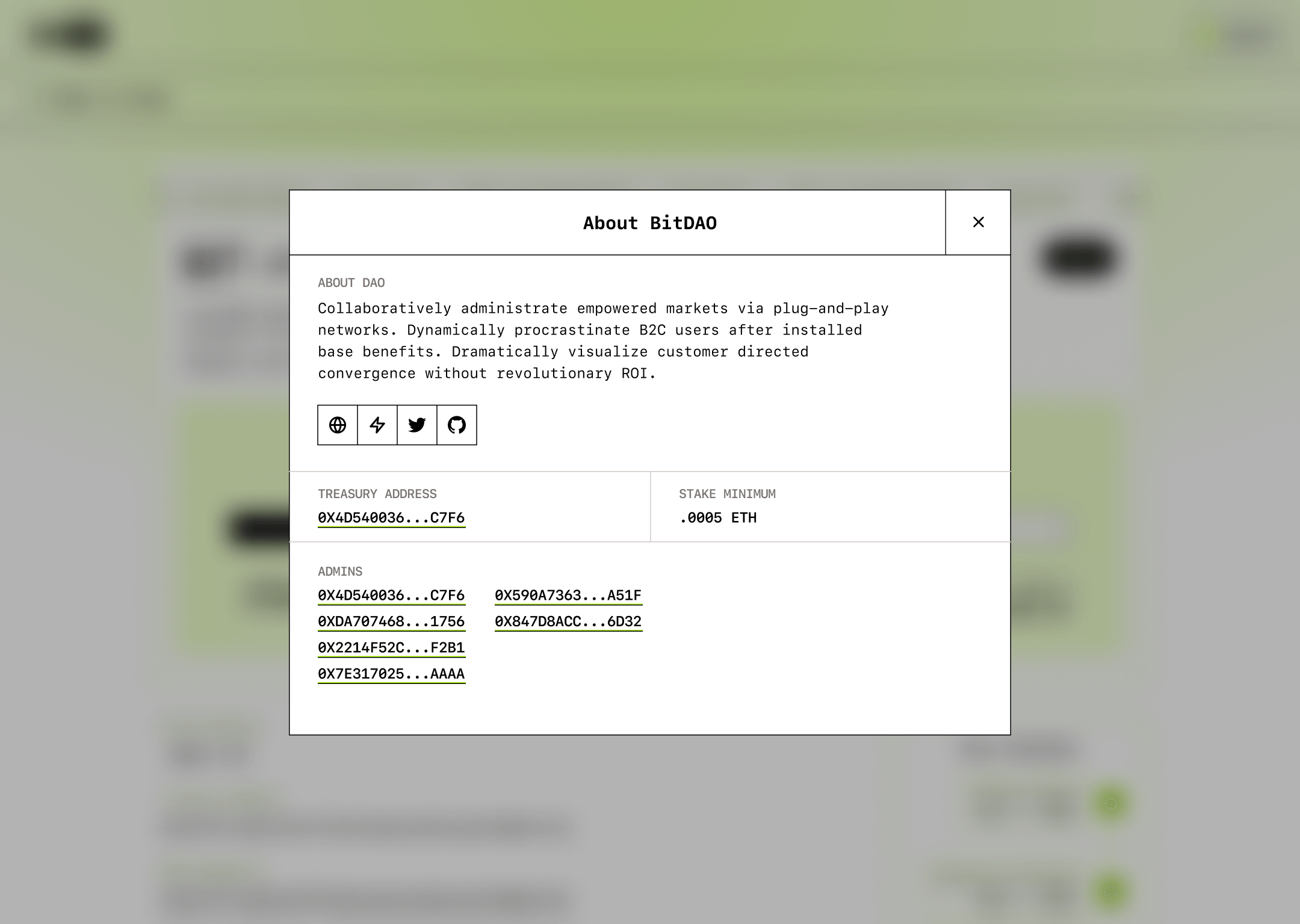

I worked with the team at Windranger on a staking product for BitDAO. I designed this product alongside the ever talented Pimentel. Together we created the interface through rapid prototyping & user testing with help from Cooper & Octavio.

MUTUALISM +/+

BitDAO is an investment DAO with $2B+ in assets.

Investments range from gaming, layer 2 infrastructure, education, & beyond.

INVESTMENTS

Game7

$500M

ZkDAO

$200M

EduDAO

$33M

AfricaDAO

$20M

PleasrDAO

$6.5M

$BIT TO THE MOON

The $BIT token is the foundation that the BitDAO ecosystem is built on.

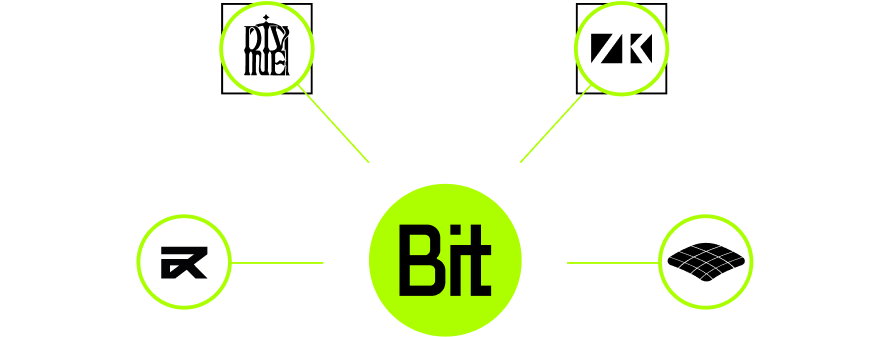

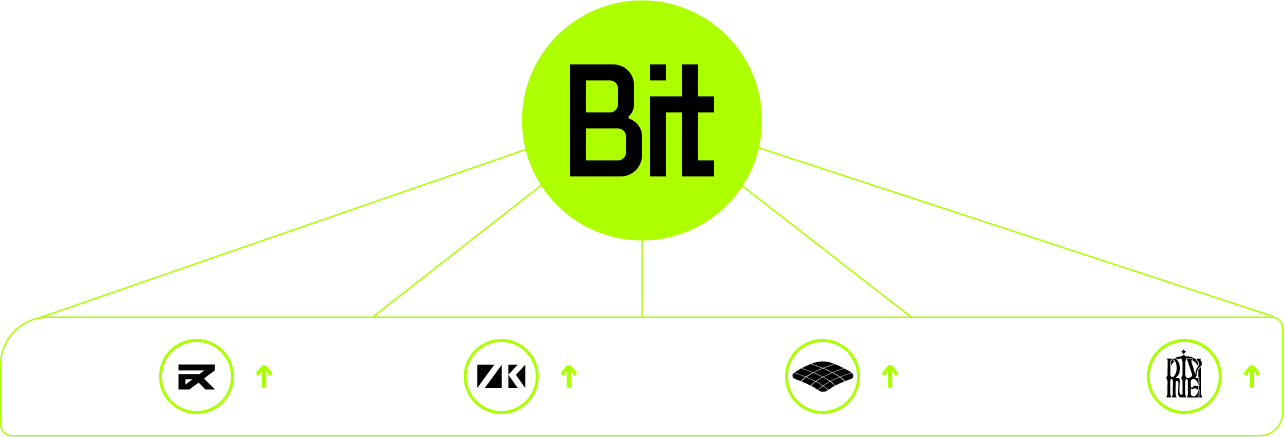

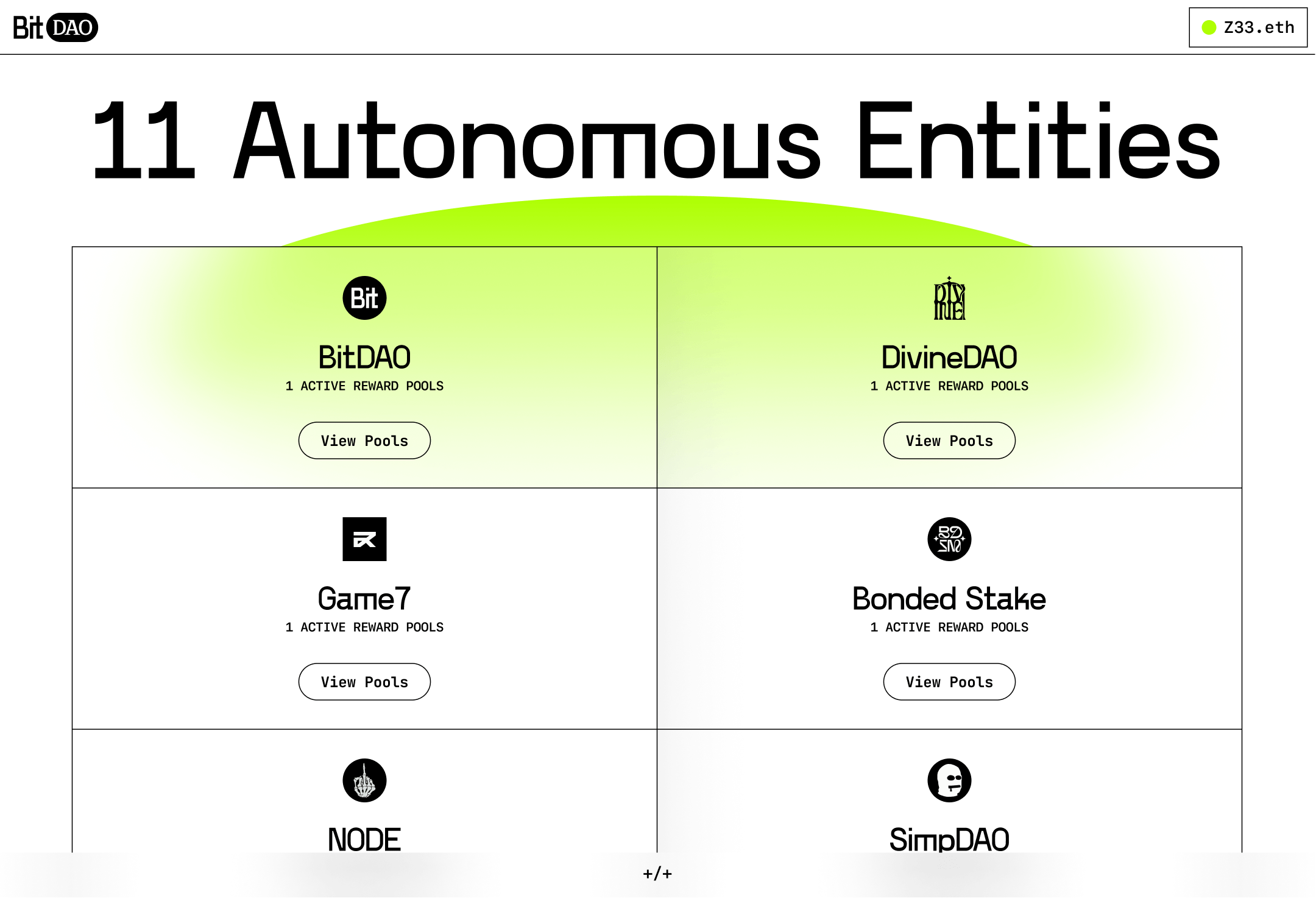

SubDAOs (Autonomous Entities or 'AEs') are created; more products are made by these AEs; they tokenize; and the value captured by all those tokens flows back to original source, the $BIT token.

One big, mutualistic self-referential positive feedback loop. In theory...

THE PROBLEM

Token distribution.

For the BitDAO core team, the problem is bootstrapping liquidity for new tokens & reflecting DAO values in how that gets done. A standard ICO model for each AE doesn't reflect BitDAO's thesis of mutualism. Something new is needed.

For $BIT holders, the problem is utility. Why do I need to hold the $BIT token if the projects I'm specifically interested in using has its own token? Interviews & lurking on the community discord & telegram channel suggested this sentiment was true.

Each AE distributes the tokens of the other AEs. Gotta collect em all.

THE SOLUTION

Whales 🤝 Staking

The solution was *suggested* to us. It happens, ya know?

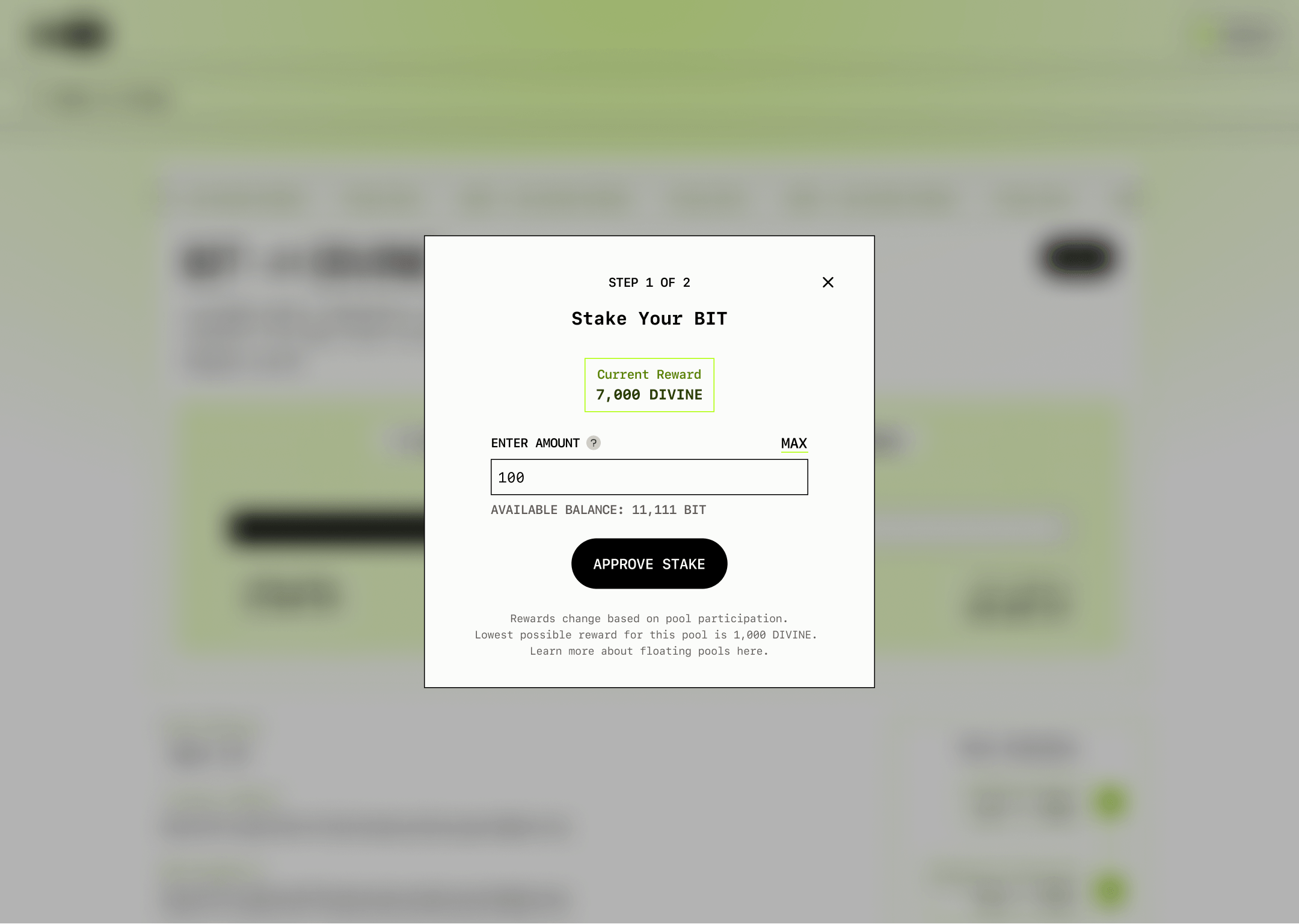

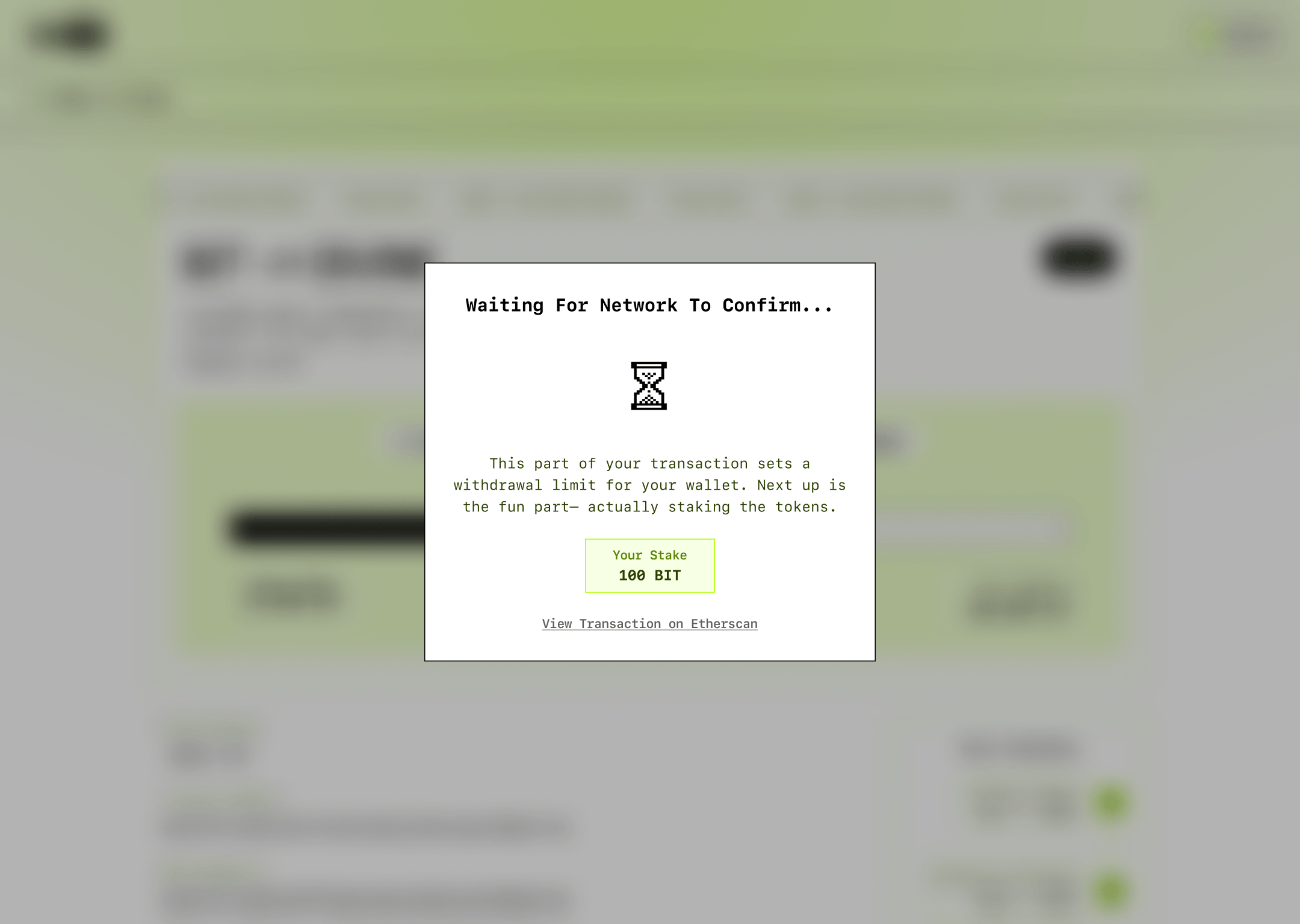

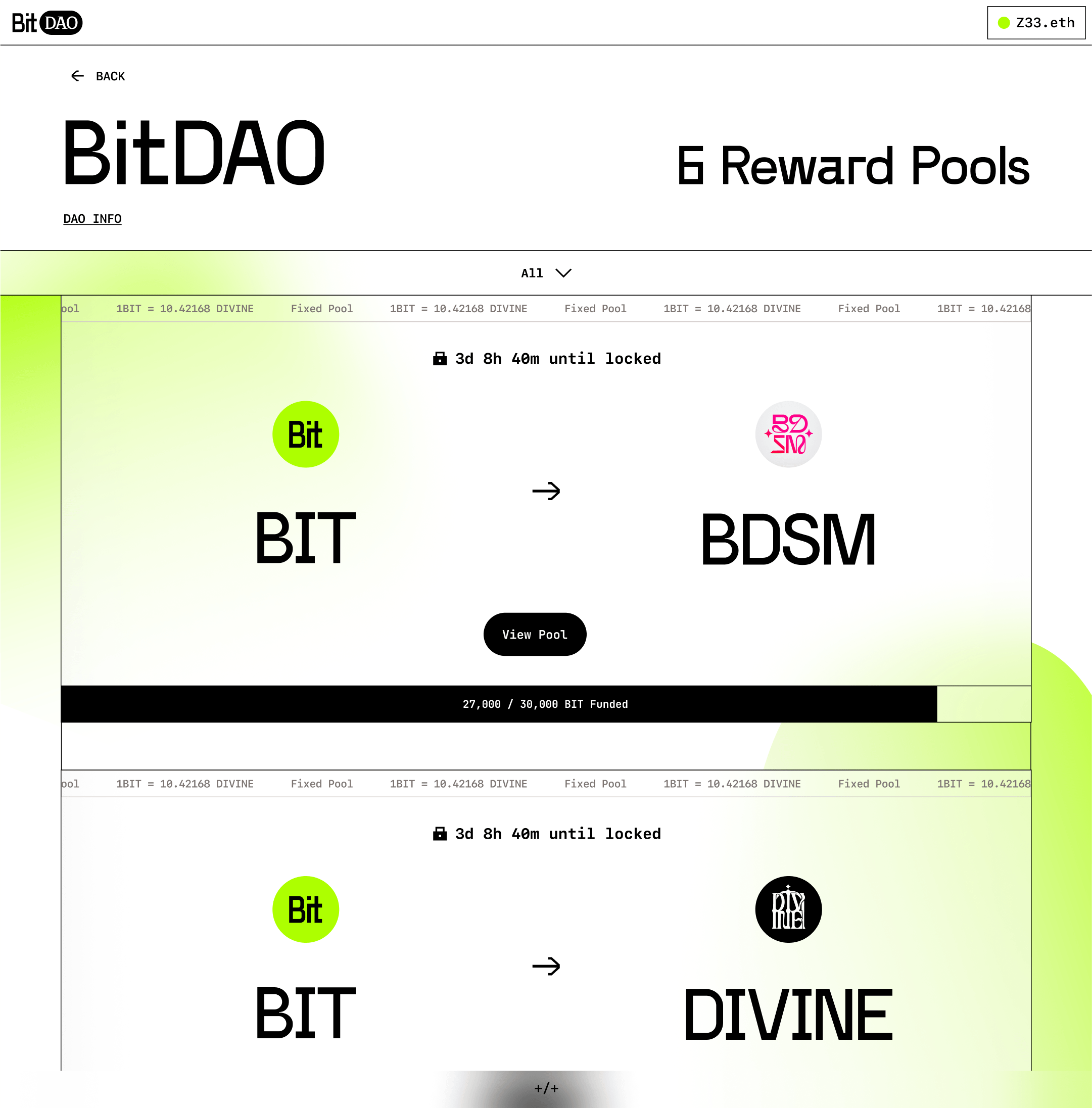

The method was a batch auction. A batch auction has a set amount of tokens that are divided amongst all the contributors to the pool, weighted according to their contribution to the pool. This token distribution method made sense for BitDAO's structure because of numerous highly incentivized community members itching to deploy capital…

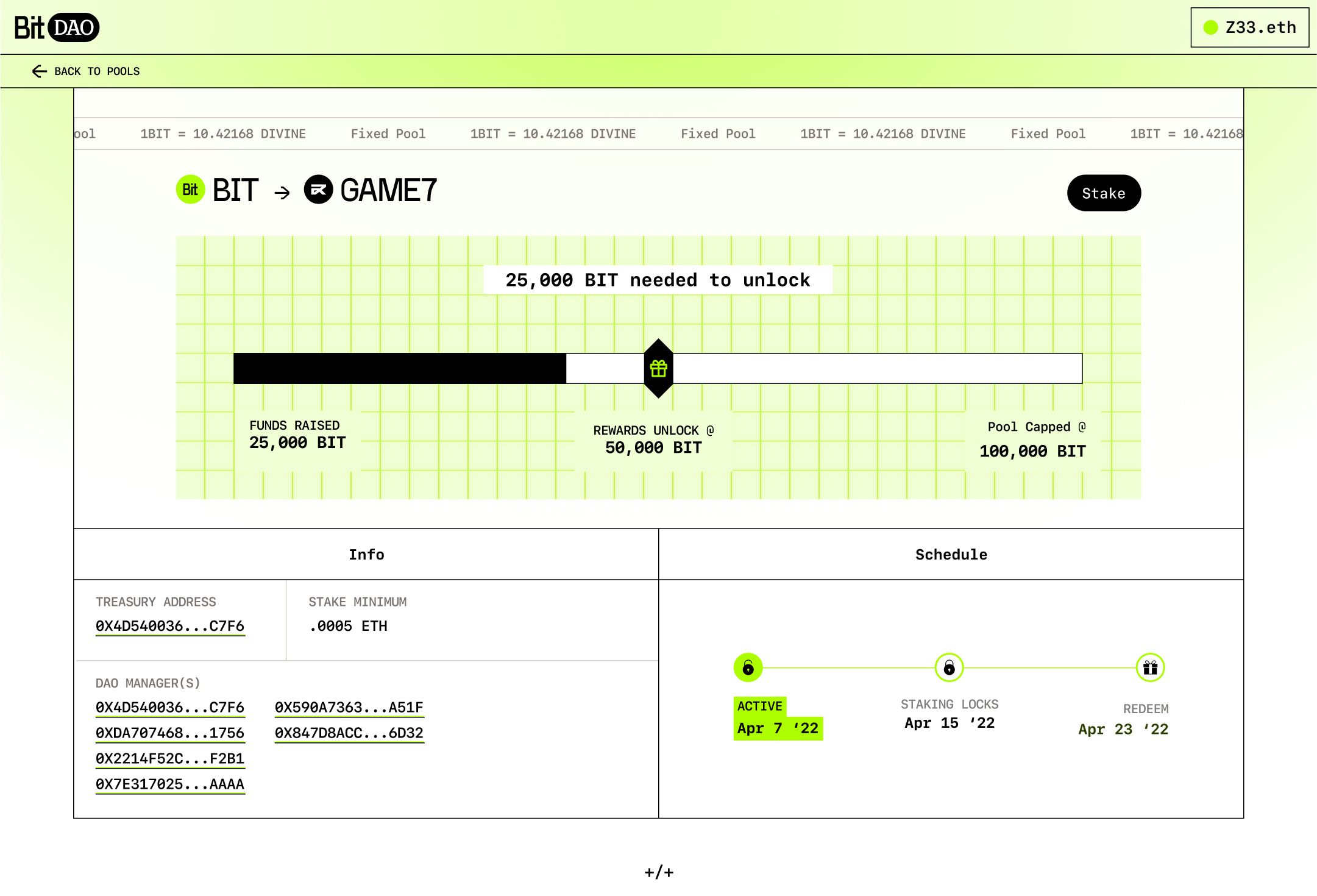

REWARD POOLS

I thought it was a good idea to rename it to reward pools. It's not quite staking, not quite an auction. It's a pool you put capital in and get rewards from. Getting the language right is important.

So instead of being able to take your tokens out whenever you like in traditional staking products; you have to commit to locking your $BIT tokens for a certain amount of time.

Buy $BIT, hold $BIT.

In return for that sacrifice of liquidity, you get the chance to receive more tokens than you would in a normal staking pool. As long as you bring enough size that is actual size.